My childhood was filled with the captivating storytelling of Mark Twain in classics such as The Adventures of Huckleberry Finn, The Adventures of Tom Sawyer, and A Connecticut Yankee in King Arthur’s Court. Unbeknownst to me at the time, each of these literary gems bore a lesson ingrained in the pen name's significance—"Mark Twain."

Samuel Clemens achieved fame under the pen name “Mark Twain” which he earned during his days as a steamboat pilot on the mighty Mississippi River. The moniker "Mark Twain" was derived from the leadman's call signaling safe water, denoting a depth of two fathoms. In this context, a fathom equated to the span of a man's outstretched arms, approximately six feet, while 'Twain' represented the number two. Thus, “Mark Twain” essentially meant "mark two" or "two fathoms deep."

The hidden lesson is clear: when faced with uncertain waters, rely on measurement to navigate safely. Just as measurement ensures a steamboat's safe passage, it provides certainty and minimizes risk when we find ourselves facing the unknown ahead.

Striking A Delicate Balance

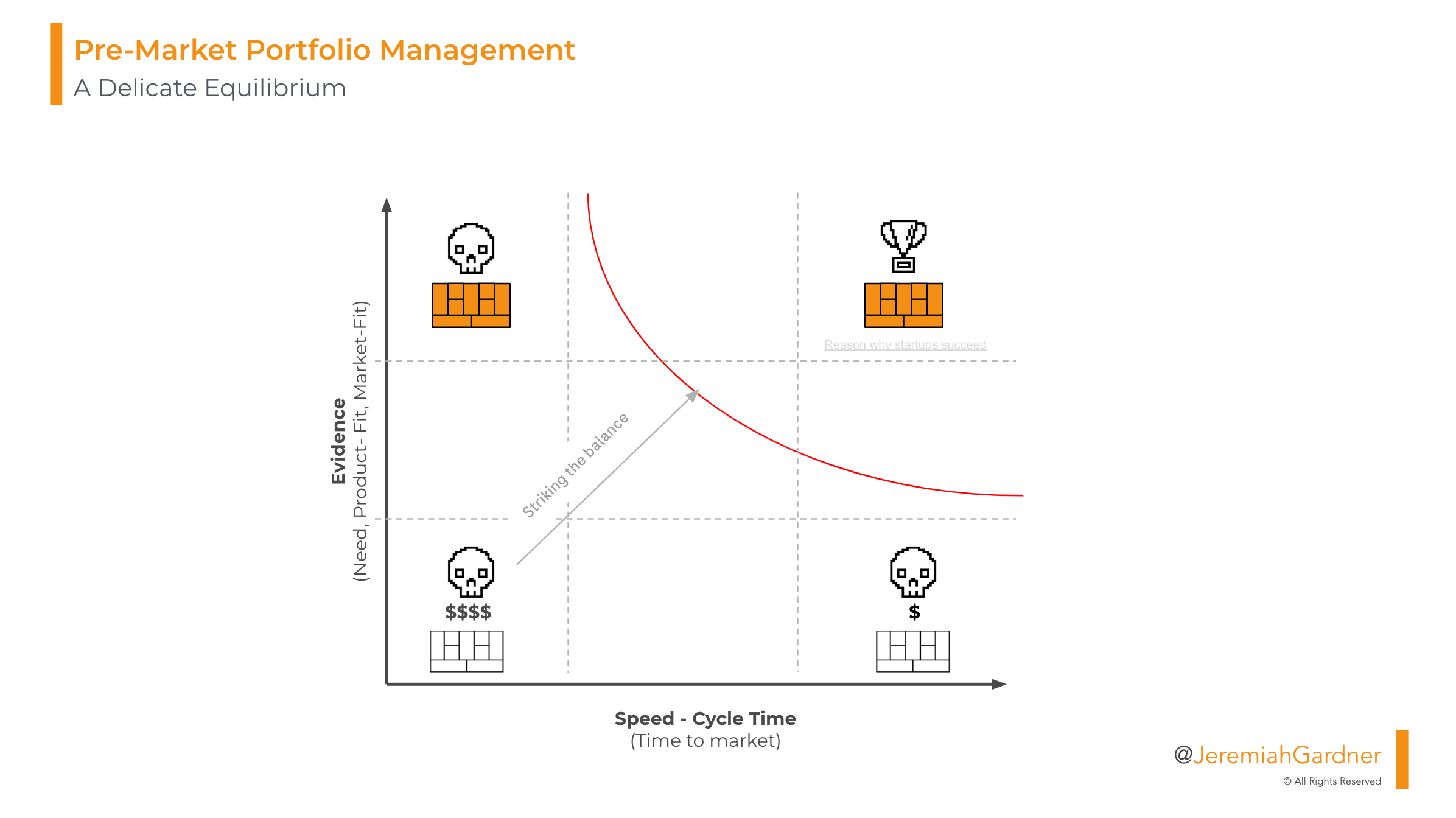

Effectively measuring pre-market innovation portfolios poses a significant challenge for large organizations. This task demands a delicate equilibrium, wherein accelerating time-to-market must be harmonized with risk mitigation through evidence-based decision-making.

Pre-market innovation portfolios are ripe with initiatives, projects, and concepts in various nascent stages of development. Unlike traditional product portfolios, which center around existing products or services, pre-market portfolios focus on future potential and disruptive opportunities. These portfolios serve to strategically innovate while safeguarding the core business and prioritizing efforts for long-term success.

The crux of optimal innovation portfolio management lies in balancing the conflicting demands of expediting product development cycles and derisking critical business assumptions. Achieving this equilibrium is elusive, as moving too swiftly may lead to uninformed decisions, while proceeding too cautiously risks missing market opportunities. Striking this balance stands as the key to effective innovation portfolio management.

But, how can you strike the balance? How can you ensure a product is developing at the right time with the right evidence? Moreover, how can you measure one developing product against another?

The Challenge: Measuring Progress, Not Performance

For existing product portfolios, a number of answers to the these questions are better established. Organizations can curate performance criteria using suites of metrics like KPIs, Pirate Metrics, Funnel Metrics, timelines, milestones, customer satisfaction scores, quality metrics, and the list goes on.

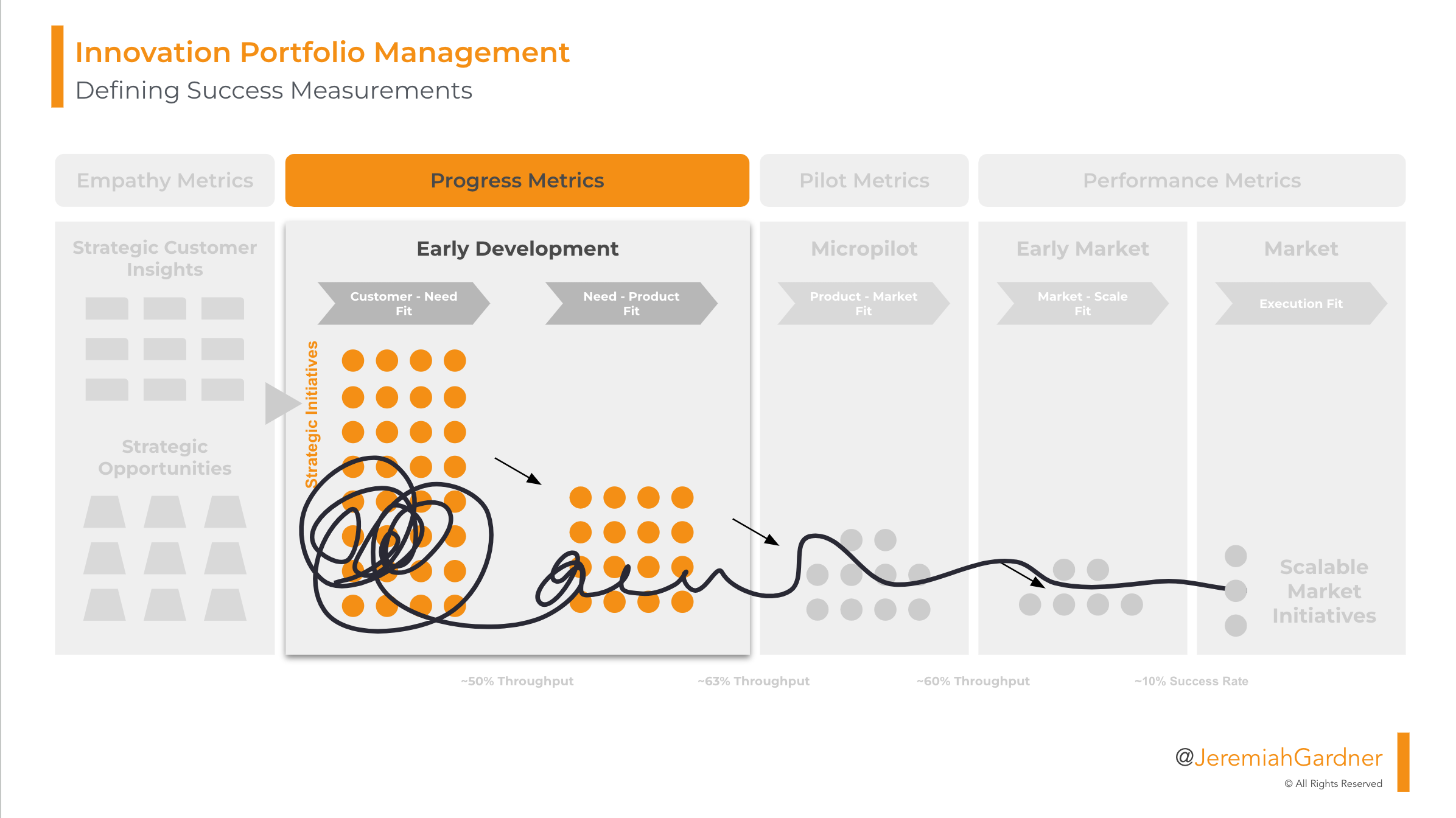

For pre-market products, the answers are much harder to come by. In my work, it was clear there was a glaring need to pioneer progression criteria to address this challenge. Over the course of many experiments and iterations, a new way to measure and track pre-market innovation portfolio products emerged that I now call Progess Metrics.

A Progress Metric is the aggregate result of confidence in a developing business model.

It is used as a single “metric that matters” in measuring the progression of a pre-market initiative and is the most important indicator of post-market business model opportunity. We measure the Progress Metric over time as a new initiative progresses through a structured product development model. In the simplest terms, Progress Metrics measure early stage concepts through objective confidence in the market opportunity of that concept.

Pioneering Progress Metrics has brought forth numerous benefits:

Single Source of “Truth”

Progress Metrics offer a quantitative, singular metric that becomes the cornerstone for measuring the pre-market portfolio's progression. Tracking historical scores and combining them with relevant project information creates a comprehensive landscape for informed resource allocation.

Progressive De-risking

By providing a standardized evaluation criteria for developing business models, Progress Metrics empower organizations to progressively increase confidence in a concept by systematically reducing inherent risks within the business model.

Objective Project Comparisions

Standardization through Progress Metrics enables objective comparisons and diverse data views, fostering balanced decision-making. This centralized hub facilitates a holistic understanding of the portfolio's progression, performance, and advancement.

Project Accountability

Progress Metrics hold teams accountable to customer-centric evidence through a standardized progression criteria. This transparency in the development process removes the "black box" stigma, aligning leaders and teams in decision-making criteria.

The Big Picture: Making Better Decisions

In the pursuit of making informed decisions within the intricate landscape of innovation portfolios, Progress Metrics emerged as a transformative key. Implementing Progress Metrics in an organization’s innovation governance represents a powerful shift in pre-market portfolio management capabilities, enhancing the ability to make better decisions in a complex and dynamic environment.

Much like the leadman calling out the depths of the great Mississippi, an innovation portfolio can better navigate the uncertain waters of pre-market product development using objective measurement.

Stay tuned for the next installment in this series, where I will delve into the functional application of Progress Metrics and the quest for optimal implementation.